The Model 3 is making an attack on Europe with electric cars

JATO has published its report on car sales in the EEA markets for Q1 2021. It is full of surprises. The Tesla Model 3 became the fourth best-selling European car, and the volume of new registrations was the second worst since 1986. Sales of diesel and gasoline engines are in significant decline.

Compared to last year, the market is growing, but it is still a miserable situation

In the European Economic Area, 1,374,313 passenger cars were newly registered in the first quarter. Compared to March 2020, this is a significant increase of 63% and yet it was the second worst first quarter since 1986. The decline of the car market to 35-year-old levels is painful for dealers as well as manufacturers. But not all of them. The radical declines in sales, together with emission regulations on cars with internal combustion engines means the time is ripe for electric cars.

Electric cars are on the rise while diesel and gasoline are slowly losing popularity

Electric car sales are skyrocketing. While in 2019 they accounted for only 4% of sales, a year later it was already 10%, and this year even 16%. In the context of total volumes, however, it is not so much growth as the collapse of the market. Nevertheless, taking a view of share of cars sold by type of drivetrain is interesting. Over two years, diesels fell from 32% to 24%, while gasoline fell from 64% to 58%. Electric cars thus ate more into the share of diesel cars, which is partially due to hybrids, which, after all, are more often combined with gasoline engines (even Volvo, who initially tried to combine diesel with electric).

Tesla Model 3 is the 4th best-selling car in Europe

What is worth mentioning is the rapid increase of Model 3 sales in Europe. With 23,755 new registrations, it placed in-between the Opel/Vauxhall Corsa and the Toyota Yaris. Only 2510 more registrations and it would have beat the Golf. It can also be assumed that those sales figures were not achieved due to lack of demand, but rather lack of Tesla production capacity. Year-on-year, Model 3 registrations increased by 52%, while the Golf saw a 43% decrease. Apart from the Model 3, the sales of only one car in the top 10 grew. This was the Peugeot 2008 with a 12% increase.

The Model 3 has become the best-selling model in the United Kingdom, France, Norway, Italy, Austria, Sweden, Switzerland, The Netherlands, Denmark, Portugal, Poland, Greece, Croatia, and, not surprisingly, Germany. However, in many of these countries there are incentives to buy an electric car as well as some other benefits such as free parking, toll exemptions, or free entry to city centers.

However, plug-in hybrids are also supported in some countries. It is therefore not surprising that all models in the top ten best-selling PHEVs enjoyed rapid growth in sales. BMW recorded the largest increases for the X1 (585% growth) and the 3-series (454% growth), followed by Volvo with the XC60 (427% growth), and the XC40 (402% growth).

European electric cars are playing second fiddle, at least for now

The rapid growth was also experienced by fully electric cars. It just wasn’t as strong. The Hyundai Kona (+228%), Peugeot 208 (+189%), and the Volkswagen Up (+187%) recorded the highest year-on-year growth. However, as much as the sales of European electric cars are growing, it is nowhere near enough to catch the competition. The American Model 3 sold more cars in Q1 in Europe than the Renault Zoe (3rd place), Volkswagen’s ID.3 (4th place), ID.4 (5th place), and Up (7th place), and Peugeot 208 (9th place) combined.

The electric offensive from the largest European and second largest global carmaker, Volkswagen, could hardly compete with another non-European player, Korean Hyundai/Kia. Within Europe’s best-selling electric cars, Hyundai/Kia have two participants – Hyundai Kona (5650 registrations and 2nd place) and the Kia Niro (4037 registrations and 8th place). In addition, another non-European carmaker, Nissan, with the Leaf (4503 registrations) made it into the top 10.

European carmakers have long lagged behind in electromobility. The only exception was Renault in cooperation with Nissan. On the other hand, the Volkswagen ID.3 and ID.4 bring significant innovation and their sales are not bad at all. It will therefore be interesting to see if and how quickly European carmakers regain dominance of the European market. The European-American Stellantis might make a splash. It holds only the last two places in the top 10 with the Peugeot 208 and the new electric Fiat 500. But more news is coming, and the ultra-compact Citroën Ami could gain traction very quickly in many cities and the island regions. After all, at home in France, you can buy it for as little as 3 408 € + 19,99 € monthly or for 7 390 €!

Source:

Loaner cars as a hidden opportunity

Many dealerships with their own service centers consider loaner cars a necessary evil. As part of the car manufacturers’ mobility warranty, they must keep a certain number of cars in stock, while others keep them for their clients to remain competitive with other car repair shops. But what if you can get even more out of it? What if a loaner car is a way to increase sales of new and used cars?

How we buy a new car

Countless surveys of pre-purchase of those interested in buying a car shows that a very important part of the whole shopping process is their own experience with the vehicle, a test drive if you will. And for some drivers, a test drive can be the main initiator of the whole purchasing process. The brands and models still exist, that serve to fulfill dreams. And it’s far from just the most luxurious or sporty segments. The problem is that it is not always possible to identify which car is the dream one for any individual. Many dreams come alive within the brand the customer has already purchased. So quite commonly the owners of a Golf dream of a Passat or Arteon, the owners of the BMW 3 series turn to the 5 or 7, while owners of a Yaris dream about the bigger Corolla or Land Cruiser. But many of them first need their own driving experience to begin to make the dream a reality. These dreams can often be fulfilled by a used model of the previous generation. Especially if their own lower-class car is several years old.

“User experience,” or the actual “ride” in the car world, is absolutely key in many other industries. However, with cars, this experience is relatively complicated, especially during coronavirus. The customer must order a test drive from a car dealer, and often feels some obligation to the dealer, which paradoxically creates a barrier to the user experience. Some dealers are very well aware of this, so they organize various open days, skid schools, etc., where they try to provide potential customers with an obligation-free user experience. This is expensive and complicated.

Loaner car as a new user experience

Every branded service center must keep loaner cars in stock. In conjunction with the dealer’s test cars, it is generally a good-sized fleet of cars covering a variety of models, equipment, and engine options. In addition, some dealers include current used cars in stock into this fleet, often out of necessity, when loaner cars run out. However, these things can be arranged differently.

Imagine that you lend an older Passat, that has been in stock for some time, as a loaner car – naturally for a very attractive price – to the owner of an aging Golf headed for warranty inspection. Or that you will lend a new electric MX-30 to the owner of an older Mazda CX-3, who uses it mainly for city driving. Or you will lend a Corolla Sports Touring that can easily fit a stroller to an expecting young newlywed couple who currently drive a Yaris. Do you think those people will be more likely to buy a new car? And how will that probability increase if you prepare a targeted offer for the loaner car, including the purchase of their existing car?

Gather information about who to lend to

That’s exactly what it’s all about. The moment you know the needs of your customers, it is much easier to sell them cars, and at a higher overall margin. The problem may be how to figure out who wants what. And then how to arrange that they get exactly the loaner car they want. Fortunately, today there are advanced CRM systems that can capture and process exactly these situations. All comments when communicating with any dealer or service, whether in person, by phone, email, or on social networks. All this is offered by Automotive CRM, a cloud-based system from Konica-Minolta for car dealerships and service centers, providing a 360° customer view. With it, you can put all your customer wishes into context, together with their currently owned vehicles and their condition. You can then easily prepare personalized offers including the targeted rental of a suitable loaner vehicle.

Automakers already sell electric cars this way, so use it for everything else

Carmakers have already caught onto the fact that loaner cars are a very elegant opportunity to support sales, especially of new and revolutionary models. Presently, they use this approach for electric cars. For example, Mazda, which relies heavily on the driving experience, has launched a targeted campaign in several markets, offering the rental of the electric MX-30 as a loaner car during service completely free for a limited time. In certain markets, this has helped to completely sell out stock of this model. But why focus only on electric cars? With virtually zero effort you can use this approach to sell any other model. Every customer has a dream car. You just need to know what it is.

Stellantis – a new no. 4 on the car market is born.

In January 2021, the world’s number 8 and number 9 carmakers in terms of production merged into the Stellantis concern. With its joint production it will overtake General Motors and nip at the heels of the 3rd largest carmaker, the Renault-Nissan-Mitsubishi alliance, which holds the lead mainly in the area of electromobility. What will the combination of FCA and PSA bring? And will all of its 15 brands survive?

What will you find in the Stellantis porfolio?

A relatively wide range of car brands can be found in the Stellantis Group portfolio. The Italian classics Alfa Romeo, Maserati, the fading Lancia and the sports version of Fiat – Abarth are the luxury brands represented. The French are adding an emergency luxury offshoot of the Citroën DS, which is already beginning to bloom as an increasingly distinctive and independent product portfolio, similarly to Genesis and Hyundai.

Mainstream brands are also represented here – American classics like Chrysler, Dodge, its spin-off and now iconic RAM brand, and also Jeep, which was the only one that managed to gain a foothold in Europe. From originally German-British-Australian origin, we have Opel and Vauxhaul, from Italy we have Fiat, while the French add Peugeot and Citroën. Similarly to how American carmakers have struggled to gain a foothold in Europe, European carmakers have trouble breaking into the US and Canadian markets. But the same does not apply for the rest of American continent.

Commercial vehicles are also included. Peugeot, Citroën, as well as the Italian Fiat Professional have producing them for decades. The latter, thanks to cooperation with FCA, has been supplying vehicles to the American market under the Ram Trucks brand.

Finally, the latest piece of the puzzle is Mopar, originally a division of Chrysler, which provides spare parts, service, and customer care for Chrysler’s portfolio brands – Chrysler, Dodge, Jeep, Ram Trucks, and formerly Plymouth, Imperial, and DeSoto. Mopar will occasionally offer special editions of these brands, most recently the 2017 Mopar Dodge Challenger.

Savings and synergies

The merger of FCA and PSA into a single group, Stellantis, will bring what every merger should bring – savings and synergies. The expected savings is already known in advance even though all factories will remain open and at current production. Stellantis is expected to save 6 billion dollars a year. From where will Stellantis realize these savings?

First and foremost, sharing modular platforms and drivetrains, as the VW Group has been doing very successfully for many years. The problem is that the North American and European requirements for NOx and CO2 emissions are not exactly compatible. This is especially the case for a number of Japanese carmakers, especially in Europe, and several European carmakers in the US. However, even if we omit the very complicated scenarios, the upside for Fiat and PSA in Europe will be significant.

Sharing the costs of developing electric cars and hybrids, including batteries, charging stations, environmentally friendly disposal, etc., is an extremely important point. As Renault-Nissan-Mitsubishi has shown, you must have scale for electromobility to work. Although Tesla has long been the synonym for electric cars, it does not make much money on them. The Franco-Japanese alliance is doing better. It manages to hold the number one position in sales of electric cars while maintaining profitability.

Savings in marketing and sales can also be expected. If Stellantis takes the VW route, as Mopar or Chrysler in the US did, and not the approach of Hyundai/Kia and earlier PSA, then it can very easily happen that joint multi-brand dealerships and service centers will appear. Moreover, as brands begin to share more key components, it’s a logical approach. For dealers and service provides, however, this will often mean the need to purchase new CRM systems that can handle more brands and share data across different company applications, marketing, and DMS. Automotive CRM from Konica Minolta is such as system, which also offers a 360° customer view across brands.

How to deal with brand cannibalization

Stellantis, unlike VW, has very elegantly stratified its portfolio of passenger car brands. Just like Chrysler, by itself, has gone the way of model diversification and individual specialized brands with Jeep, Ram Trucks, and Dodge offering distinct products. Fiat was also able to elegantly differentiate with Fiat, Lancia, Alfa Romeo, and Maserati offering little overlap between the brands. PSA was worse in this respect, but Citroën and Peugeot were able to differentiate in design and some of the specialties that Citroën kept for themselves. PSA as well as Opel/Vauxhall were then able to target a completely different market segment than Fiat and their brands.

The only areas time when it gets a bit muddy for FCA and PSA, more precisely for Fiat and PSA, is in commercial vehicles. But here they can take advantage of economies of scales. This may be particularly useful to Stellantis in the situation where the main rival of PSA, Renault, is toying with the idea of extending cooperation with Daimler in the area of commercial vehicles.

Overall, however, Stallantis has a great chance of avoiding the problems facing VW, where, for example, the Volkswagen Passat and Škoda Superb are fighting for de facto identical customers, while both brands are also pulling customers away from the sister Audi A4. Nevertheless, it is likely that Stellantis’ product porfolio will narrow. After all, the number of new models from Lancia, Alfa Romeo, Abarth or Fiat is not too large.

Strengthening in Americas and Europe, expansion in Asia and Africa

However, the Stellantis group does not plan to only save. On the contrary, it wants to jointly attack markets where it is not yet doing well. Namely Asia (mainly China and the Middle East) and Africa. Already the current product portfolio has something to offer for all three of these regions. For the Middle East, for example, Ram Trucks and Jeep are not in a bad position at all. The potential multi-brand dealerships will be able to choose the brands best suited for each region.

It is thus possible that in Africa or the Middle East, we may see Stellantis dealerships exclusively for 4x4s – from the cheapest Peugeot, Citroën and Opel cars, through utility Ram Trucks, more off-road oriented Jeeps, and luxury SUVs from DS, Maserati, or Alfa Romeo. It is also worth noting that Stellantis plays a relevant role in the minivan/MPV category, which are still sought after in Asia. There, the combination of large American MPVs from Chrysler and Dodge with smaller European MPVs from Citroën, Peugeot or Opel could be a big hit. Let’s let them surprise us.

Sources

https://www.wheels.ca/top-ten/these-are-ten-biggest-automakers-in-the-world/

https://www.carscoops.com/2020/06/renault-boss-keen-on-rekindling-partnership-with-daimler/

2030: Electric Odyssey – Electricity Is Changing the Way Cars Are Sold

More and more brands are moving towards complete electrification. Volkswagen, Ford Europe, Jaguar, Volvo, General Motors, and soon other carmakers will soon likely switch to electricity. Jaguar will be the first to do so by 2025, and most of the others will do so by 2030, with General Motors coming in last by 2035. However, with the change of propulsion, the business model will also change. What will this change mean for dealerships?

Say goodbye to internal combustion engines

Volkswagen will no longer develop new internal combustion engines, and the existing ones will ride out the era. At the beginning of March, this news unsettled the share price of the 2nd largest carmaker, but in a positive direction. During March, the share price jumped by an incredible 34.3%. By 2030, 70% of VW brand cars sold in Europe will be electric. In China and the US, it will be half that. By 2025, the carmaker will invest 16 billion Euros in e-mobility, hybridization, and the digitization of its cars. Autonomous driving should arrive by 2030.

Volkswagen is far from the only manufacturer to follow this trend. In January this year, General Motors announced the full electrification of all passenger cars, trucks, and SUVs. They came with his announcement just a day after the new American president returned to the fight against climate change. However, car manufacturers have other motivations for electricity. Jaguar Land Rover, which will convert its Jaguar brand by 2025 and the Land Rover brand by 2030, is looking for additional reliability that comes with electric power. The carmaker has been battling with reliability for a long time, and with electricity, it might finally have a way to get rid of the “unreliable” label.

Volvo will switch to a new sales model, and they’re not alone

Volvo, which in parallel has already launched its fully electric brand Polestar, that deals with certain childhood illnesses, has also opted for electricity from 2030. However, the propulsion system is not the only thing that will change. The carmaker plans to start selling all of its cars directly and online, similar to Tesla. From 2030, it will “sell” its cars in the form of a fixed monthly fee, including all service, insurance, and assistance services. This business model has long been used by Toyota worldwide for its Mirai hydrogen vehicles. However, Volvo and Toyota are not the only carmakers to toy with this business model. Many car manufacturers, most notably Volkswagen, play a key role in the area of finance, specifically of course, operational leasing. A car in the form of a service is popular in more and more countries around the world.

Direct sales from car companies will also radically change the dealer’s business model. They will continue to earn money from the service of these cars, perhaps much more than before because this business model will de facto end non-branded services. But then again, they will lose some of the commission from car sales. However, they may be able to sell different “things,” and we do not mean only accessories.

What does “digitization” mean?

As we said above, part of the 16 billion EUR that Volkswagen will invest over the next four years will go to digitization. This trend is also being followed by other car manufacturers such as Daimler (Mercedes-Benz) and BMW. But what does digitization mean? The idea is simple and again it is partly inspired by Tesla. As early as 2019, Mercedes-Benz stated that it wanted to earn from the sale of additional services and functionalities through its new MBUX on-board system platform. Initially, it started selling features such as Digital Radio, Apple CarPlay/Android Auto, and on-board navigation. In the future there should be many more features on offer. The car comes with all the features, which makes it cheaper to manufacturer at scale, and then they are only activated remotely.

A major breakthrough in distance-selling digital services will be autonomous control, which VW for example, has promised from 2030. There will be many more digital services, perhaps those we cannot imagine at the moment, and which will be location dependent. Today, we can mention for example, an overview of free parking spaces, or even automatic payments for parking, which are features that carmakers are currently testing in some German and American cities.

Of course, all these services will be sold directly by the carmakers. The transition to on-board systems with over-the-air updates will allow them to do so without any problems. But what carmakers cannot always do directly is sell the SIM cards that the cars need for connectivity. In addition, some customers will need help with the installation of some services, and that is something the carmaker will not be able to help with directly. It can easily happen that dealers will also perform the role of “user support” and training, as was once the case with computers, and later with mobile phones. Additionally, there may be potential for the sale of telecommunications services.

Will dealers also sell electricity?

Electrification brings another key element that not only automakers will have to tackle, and that is recharging. At the beginning Tesla incorporated a dumping policy, offering electricity at its own network of Tesla Supercharger stations to its car owners free of charge. Later, however, they started selling Supercharger access. Other carmakers are also building their own charging networks, usually in consortiums. The most important of these is IONITY, which currently brings together BMW, Ford, Hyundai, Mercedes-Benz, Volkswagen, Audi a Porsche. But most charging takes place locally, at a customer’s home or work, where the car is parked for many hours at a time and can be recharged in a slower and more battery-friendly way. However, customers then need to purchase the electricity from someone. In the European Union from an energy trader as European regulation has unbundled the electricity business into separate services of production, distribution, and sales to end customers.

At the same time, the electric car will need much more electricity and thus possibly a different supplier or tariff from the home or business. And within the sale of electricity are similarly high commission as in the sales of loans or insurance. This is a great opportunity for dealers, because the concept of local electricity sales and distribution are infeasible for car manufacturers. In addition, some owners of electric cars are of course interested in solar panels. It is no coincidence that Tesla bought the company SolarCity, which produces photovoltaic panels. So even this could be a very interesting new opportunity for dealers.

Say goodbye to your current business model

Thus, by 2030, a large part of car dealers will have to say goodbye to the existing business model and reorient themselves to the completely new operating conditions of the market. At the very least those selling Volvos. Most do not have the appropriate know-how or equipment to sell services, consulting, training, or especially electricity and photovoltaic panels. But a flexible and professional CRM system can easily help with this. For example, the cloud-based automotive CRM tool can perfectly cover existing sales, service, marketing, and customer car processes of the car dealer. However, thanks to its flexibility and cloud platform, it can quickly learn any other processes. Extending the existing CRM to the sale of services or other products is a breeze, especially when the company behind this system, Konica Minolta, has been supplying CRM systems in the fields of energy, including electricity distribution and sales, or service companies for years. And how are you prepared for Odessey 2030?

Sources

https://www.motor1.com/news/495958/vw-stopping-gas-engine-development/

https://www.cnbc.com/2021/03/05/vw-expects-half-of-us-sales-to-be-electric-vehicles-by-2030.html

https://www.bbc.com/news/business-56072019

The European car market is in decline, what to do now?

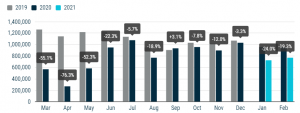

The European car market is in a sharp decline. According to data from the European Automobile Manufacturers Association (ACEA), year-on-year car sales fell by 24% in January and 19.3% in February. After a promising December, when the year-on-year decline was only 3.3%, this is a shock. What can you do as a dealer to maintain your sales performance?

The entire EU is in the same boat, with one exception

The drop in sales has affected all EU Member States. The largest year-on-year decreases were recorded in January and February in Lithuania (-46.5%), Portugal (-44.6%), and Denmark (-40.1%), with the smallest in Estonia (-8.8%), Finland (-8%), and Hungary (-6.8%). However, one and only country saw an increase in sales, and that was Sweden, by 12.8%. Sweden is known for its completely different approach to protecting its population from the coronavirus. This is the only significant difference from other EU Member States. Sweden has invested in maintaining normal life with some limited restrictions. Car sales have more than felt the positive effect of this policy.

Figure 1 – Source: ACEA

Other more sparsely populated countries in Europe are also holding steady

Outside the EU, there was another country that saw some growth, and that was neighboring Norway. There, sales increased by 5.4% year-on-year. Norway is unique in being the the only European country in the world to belong to the top 10 countries who best dealt with the coronavirus crisis, at least according to Bloomberg. In March, Norway had only 362 infections per 100,000 inhabitants, however, in all key metrics it did not differ much from the number 14 ranked Denmark, where car sales fell sharply.

However, the main driver for the increase in car sales is probably the enormous size of the country and the associated population density, which is the lowest in continental Europe (14 people per km2). Finland (16 people per km2), Sweden (23 people per km2), and Estonia (29 people per km2) are also not densely populated countries. In addition, Norway has long supported the sales of electric cars, which make up a considerable proportion of all cars sold. In contrast, neighboring Denmark, which has seen car sales fall sharply, has a relatively high population density (135 people per km2), which is similar to Portugal (112 people per km2). An exception, however is Lithuania (43 people per km2), where the state of the economy following coronavirus may play a role, as well as Hungary (105 people per km2), which is on the other side of the spectrum as the one of the few countries in Europe which closed its state borders.

What to do about declining sales

European market data clearly shows that declining sales affects the vast majority of European countries. It is due to both the economic recession and, apparently, a change in people’s habits. Where governments have implemented lockdowns, travel has simply decreased, and so has the need to buy new cars. Car dealerships in countries with higher population densities have a greater problem, where public transport is usually more accessible and there is less of a need for long journeys to work. While cars used to be sold widely and often according to similar rules and pan-European marketing campaigns, the COVID-19 pandemic has created massive differences between countries and groups. Presently, such widespread campaigns simply do not work anymore because in most European countries, only certain groups of population really need cars. What can be done about this?

Cars are sold only by those who know what customers need them

In order to continue selling, you need to know your customers in great detail. And you just have to be able to find them at the right time. It is obviously easier in Sweden than in Denmark. The examples of Sweden and Norway may also give dealers in other countries the hope that when life in a given country returns to normal, car sales will resume. Until then, however, it is necessary to incorporate all the appropriate marketing skills and corresponding tools. The key to success will be the extraction of current customer data, for example from the service center, but also from certain social networks.

Automotive CRM, a cloud CRM that can incorporate data from service, sales, e-mail, and phone contacts, as well as interactions from social media thanks to which it provides a perfect 360° view of each potential customer, can help you. It can then divide the customers into various groups, to which it can precisely target marketing campaigns. In short, it allows you to sell specific models that meet the specific needs that specific customer groups looking for new or even used cars may need. For example, families with newborns, families with a 3rd child, or companies and individuals whose current car has rising service costs and is likely at the end of its life.

Sources

https://www.bloomberg.com/graphics/covid-resilience-ranking/

https://en.wikipedia.org/wiki/Area_and_population_of_European_countries

Apple is entering the automotive space. What does it mean for auto dealers?

Apple has been working hard to develop its own autonomous electric car since 2014. However, the project has not been very successful. In 2016 there were rumors that Apple would cancel the program. At the end of 2020, however, new rumors began to surface and in February this year, they announced their deal with Hyundai fell through. So, what is the situation now with Titan and how will Apple change car sales?

Delight of Tesla and fear of Google

The reason why Apple began investing in entering the automotive industry in 2014 was clear. At that time, Elon Musk had been successfully producing and selling the Tesla Model S for two years. It changed the “user interface” of cars, and in October 2014 introduced its advanced assistance system, somewhat optimistically titled “autopilot.”

But there was another, much bigger threat for Apple, and that was Google. Google has been secretly supporting the Pribot project since 2008. This project aimed to transform the classic Toyota Prius into a fully autonomous vehicle. Unlike with Apple, Google’s efforts for secrecy were so effective that the project only came to light on October 9th 2010, thanks to an article in the New York Times.

When legislation for testing autonomous vehicles was introduced in Nevada on March 1st, 2012, Google was one of the first companies to obtain a testing license. However, as it turned out, Google never sought to build its own vehicle. It was mainly concerned with technologies for autonomous management, which today fall under its daughter company, Waymo. It has also been testing these technologies in collaboration with Fiat Chrysler Automobiles since July 2020, more specifically for Ram ProMaster deliveries (also known as Fiat Ducato, Peugeot Boxer, Citroën Jumper, Citroën Relay), for which it will deliver level 4 autonomous control.

Renewed hopes for a new car

After an embarrassing start, when in 2016 it looked like the Titan Project would be put on hold, Apple really leaned into the development of the car again in 2018. During the summer of that year, it recruited Doug Field, a Tesla engineer, raising renewed hopes in an Apple vehicle. But in January 2019, bad news struck again – Apple fired 200 people from the Tital Project, apparently a fifth of all project employees. That didn’t bode well for the future of the Apple electric car.

However, in December 2002, there were reports that Apple was not only working on an autonomous electric car but had come up with new battery design that would save space, creating the potential to install batteries with a higher capacity and therefore, a longer range. It has also been announced that Apple is researching a new type of lithium iron phosphate battery, which does not suffer from the typical problem of Li-ion batteries overheating, thus making it easier to recharge quickly and providing increased resistance to peak consumption, such as in sporty driving. Batteries are the key to success in electric vehicles, which Tesla, who has been cooperating with the Japanese firm Panasonic, knows very well.

Cooperation with Hyundai/Kia is not likely

But batteries alone are not enough. Nevertheless, by the end of 2020 it began to look like Apple had much more. They announced discussions with the automotive manufacturer Hyundai/KIA on the topic of an autonomous electric vehicle. But by February 2021 that proved to be a thing of the past. The South Korean carmaker said the talks with Apple were concluded without an outcome and it was negotiating with other suppliers of technologies for autonomous systems – here it is appropriate to recall Google (Waymo) as a key player. However, the shares of Hyundai and KIA did not react to the Apple news very positively with Hyundai dropping 6.2% and KIA even 15% just that day.

Will we see an Apple car?

The key question thus remains whether we will see a car with an Apple logo in the near future. According to many speculations, it seems like we will. The launch date usually oscillates between 2024 and 2025. The important question is whether existing car manufacturers and dealers should be concerned.

But is the automotive industry so similar to the tech industry? Elon Musk showed that the rules of the game can be changed even on the car market. Apple’s talks with Hyundai/KIA also suggest that Apple may not even want to produce cars on its own. Maybe they will want to transfer their business model, where they play the role of a design studio, to the world of electric cars. However, the question remains as to what their sales and service would look like. The most likely option are their own branded stores. But we’ll have to wait a few more years for that.

Sources:

https://www.autocar.co.uk/car-news/new-cars/200-staff-axed-apples-project-titan-autonomy-project

https://www.macrumors.com/2020/12/21/apple-car-production-rumored-2024/

https://www.theverge.com/2020/7/22/21334012/waymo-fca-ram-delivery-self-driving-van

https://en.wikipedia.org/wiki/Waymo

Hydrogen propulsion is being pushed among luxury limousines; will it succeed against BEVs?

Hydrogen propulsion has been talked about for decades. Daimler has given up while Toyota, Hyundai, and Honda are just kicking it off. What makes it better than electric drive by batteries and what does the future hold? And why is Toyota’s CEO warning against electric cars and talking about a new sales model?

The luster and misery of hydrogen propulsion

Hydrogen propulsion is not so much propulsion in the true sense of the word. Even hydrogen cars (FCV) are electric cars and are powered by one or more electric motors. However, the main difference is where the energy for the electric motors comes from. While conventional EVs (electric cars) reply on energy storage usually in the form of Li-ion batteries and a simple electrochemical reaction, hydrogen cars rely on fuel cells. The principle, invented in 1838 by Sir William Grove, relies on a simple redox reaction between compressed hydrogen in the car’s tank and atmospheric oxygen and takes place in the car’s fuel cell. The “exhaust” is then just ordinary water.

A clear advantage of fuel cells over batteries is the stability of their capacity regardless of the outdoor temperature and the stability of their “charging” rate (replenishment of hydrogen in the tank) regardless of the outdoor temperature or the previous load of the fuel cell. The obvious disadvantages compared to batteries are larger size for the time being, and especially the lack of a hydrogen fuel station infrastructure. In the entire United States, there are only a few filling stations in California. Hydrogen technology is also clearly more expensive to produce. With the first generation of the Toyota Mirai hydrogen, which sold 10,000 units, Toyota reported lost $100,000 on each unit delivered.

Why hydrogen can be interesting

Akio Toyoda, president of Toyota, is currently the only high-level manager in the ranks of the major car manufacturers to oppose electric cars. And he has his reasons. Electric cars are becoming heavily dependent on the world’s lithium reserves. However, the consumer electronics industry, and, to a lesser extent, medicine (specifically psychiatry) also needs large amounts of lithium. Demand for consumer electronics is growing even faster than for cars.

In addition, more and more countries, including Japan, are beginning to face problems with the power grid. This is due not only to increasing consumption, especially on hot summer days, but also to an increase in the share of renewable energy sources. Countries that regularly experience blackouts, such as Australia, are building gigantic and expensive lithium electricity storage. As Toyoda mentions, soon there may not be places to charge electric cars. Another factor (or maybe the consequence of above mentioned) is the ever-increasing price of energy at charging stations. Even Tesla has long ceased to offer charging to its customers for free, which has begun to fundamentally change their total cost of ownership (TCO).

Hydrogen is being pushed into buses and the military

For hydrogen propulsion to gain the traction it needs to survive, it will need massive support not only from carmakers, but also from customers and governments. After all, sales of electric cars were kickstarted by massive state subsidies. And it’s slowly starting to happen. Hydrogen is becoming part of regular bus transport in the Netherlands, and part of the US military. GM Defense, the General Motors division supplying military vehicles, is preparing the new SURUS hydrogen autonomous cargo platform and has successfully tested the Chevrolet Colorad ZH2, hyrdogen fuel-cell, with the US army. Joe Biden has made it clear that after his arrival, America would fight climate change like never before, so hydrogen fits right in.

The business model of “selling” cars will change

However, with the availability of hydrogen cars, Toyoda talks about one more thing that is important for car dealerships. The head of Toyota says that with the advent of FCV, the sales model will significantly change. And the sales of the Mirai testify to this. The first generation, similar in appearance to the Prius, could only be rented, and while the new upcoming luxury Mirai sedan can also be purchased, the TCO will be incomparably higher than renting.

In addition, Toyota will apply its new business policy in France. There, through its French joint-venture, HysetCo, founded with French gas concern Air Liquide, it wants to get 10,000 Parisian taxi drivers to switch to the new generation of the Mirai. HysetCo approached this through the acquisition of Slota Group, a small Parisian taxi operator with 600 cars, which they will now replace with the FCV. A model in which the carmaker delivers its cars directly to customers would be a double dose of bad news for car dealerships. For the time being, however, FCV sales are focused only in select locations, such as Paris or California, where hydrogen filling stations exist.

Sources:

https://cleantechnica.com/2014/11/19/toyota-lose-100000-every-hydrogen-fcv-sold/

https://www.wsj.com/articles/toyotas-chief-says-electric-vehicles-are-overhyped-11608196665

https://www.abc.net.au/news/2018-09-27/tesla-battery-cost-revealed-two-years-after-blackout/10310680

https://www.greencarcongress.com/2020/04/20200415-solaris.html

An unexpected problem of smart cars – a computer component failure

When the Tesla Model S first appeared on the car market, it was as if it was out of a sci-fi movie. Surprisingly, it was not because of its electric drivetrain. After taking over Tesla (already from the Roadster model), Elon Musk began to put an enormous emphasis on the “user interface.” It paid off. However, now the NHTSA has discovered a serious problem. Computer components may not be suitable for cars. This may, however, be a great opportunity for car service centers.

A new trend with new risks

Elon Musk came to the automotive industry from the internet world. He therefore knew that the user interface, or more precisely the user experience, plays an absolutely critical role not only for overall user satisfaction, but also in the way that the user talks about the service or product. In other words, word-of-mouth marketing. This is how Tesla built its success. His vision at the time was to make a car that is as user-friendly as the iPhone.

When, in 2012, Elon Musk introduced a passenger car with a gigantic vertical display instead of the usual series of displays, buttons, and controls, it was a shock. The shock paid off and today everyone, including the new generation of the Mercedes S class, are copying this setup. For the first time, Elon Musk decided to use the relatively cheap and readily available components from existing mobile devices, and it panned out. Thus, a de facto new trend began, where formerly purely computer companies such as nVidia suddenly began to enter the automotive industry.

Computer companies took the automotive world by storm

The arrival of computer companies was marked by another key trend in which Tesla was a pioneer – advanced driver assistance systems (ADAS) based on artificial intelligence. nVidia joined this trend only recently, at the end of 2018, and was able to gain the best position in just two years, when last year it signed an exclusive agreement with Mercedes-Benz, a company with a history of safety since the fatal accident at LeMans in 1955. The Mercedes S-class was in fact considered the benchmark of new driver safety technologies until the entrance of Tesla.

According to the NHTSA, 158,000 Teslas have a serious problem

While nVidia’s collaboration with Mercedes and other key players is a rather recent phenomenon, with Tesla it was different. Its technology, specifically the nVidia Tegra 3 processor used in mobile phones and tablets, was an integral part of the “tablet” user interface or MCU (Media Control Unit) in the Model S from 2012 to 2018 and in the Model X from 2016 to 2018. From 2018, with the new generation of Autopilot and AI (artificial intelligence) from nVidia, other on-board electronics have also been replaced.

But now NHTSA has come across a Tesla pain-point, that Elon Musk probably didn’t anticipate. The nVidia Tegra 3 tablet and smartphone processor was supplemented with 8 GB of flash memory, which was quite a common thing for Android phones and tablets at the time. However, the lifecycle of a smartphone and a car varies quite significantly. And the flash memory used in conjunction with the processor can “survive” an average of “only” 3,000 read-write cycles, which, according to the NHTSA, is enough for 5 to 6 years of use – plenty for a phone, but not enough for a car.

In the US, the NHTSA has already registered a total of 12,588 incidents involving the MCU, which controls the built-in screen in Tesla vehicles. The agency is therefore considering a full recall, in which Tesla would be required to replace the flash memory in the MCUs. This could mean up to 158,000 cars.

What will this mean for the future of smart cars?

According to the director of nVidia, smart cars will make up 20% of the total passenger car market by 2030. Onboard systems with computer electronics and touchscreens will be far more common. However, manufacturers will have to start paying close attention to the components used. They will clearly have to meet one more criterion in addition to the SAE criteria for automotive electronics – overall lifespan. And with the advent of coronavirus, this lifespan is increasing. There are a number of countries where the average age of registered passenger cars exceeds 10 years, sometimes even 15 years.

And here we come to the great news for automotive service centers and possibly also car dealerships. It is quite probable that the Tesla Model S will not be the first and only car with modern on-board systems, which over time will struggle with lifespan problems, for example with memory, disks, and SSDs. However, unlike with a tablet or laptop, the replacement of these components is not so easy for users to arrange on their own. The time will come for service centers, for which the replacement of on-board electronics will be an interesting growth opportunity. For example, services can record the status of electronic components in their CRM and recommend customers a timely replacement during a standard service interval. At the same time, it is an opportunity for car dealerships to offer their own special options in the form of extended warranties for electronic components in the on-board systems. Are you prepared to replace computer components in your service center?

Sources

https://www.eetimes.com/nvidia-enters-adas-market-via-ai-based-xavier/

https://www.motortrend.com/news/tesla-model-x-s-nhtsa-screen-recall/

https://europe.autonews.com/automakers/nvidia-ceo-says-software-will-soon-define-car-drive-profit

Photo by Chris Ried on Unsplash

Google: Coronavirus has changed the automotive market. But in a different way than you might think

The fact that Google is looking into the automotive market is nothing new. Today, however, we will not be speaking about their efforts to develop autonomous vehicles, but about a total of 11 market surveys that they conducted during the coronavirus pandemic. The results of these surveys are critical for car manufacturers and dealers, and quite surprising.

Customers are already looking for something else in their cars

Google is primarily a search engine. For a long time therefore, it has observed trends in what its users are looking for. In the area of car sales, much has changed over the past year. Google has seen an 80% year-on-year increase in searches for “best car under,” and even a 200% year-on-year increase in searches for “nearest RV (caravan) rental.” The pandemic has reduced family budgets for the purchase of new and used cars, and at the same time changed travel conditions. Many people, rather than book hotels (which were often closed anyway), began looking to rent caravans for longer trips to the countryside.

The pandemic attracted new interest to the automobile

However, these are not the only changes that coronavirus has brought to the passenger car market. In a survey from May 2020, PwC noted that 77% of American consumers perceive commuting by public transportation as a health risk in terms of the disease. In addition, 30% of Americans that took a trip by car, did so just for a “change in scenery.” A completely new segment of customers began to emerge, not only in America, for whom public transport or taxis were not sufficient for their needs. They no longer wanted to risk infection and/or they wanted to travel somewhere further out of town to clean their heads from the persistent lockdown and working from home.

During the coronavirus pandemic, cars were sold differently

All of us can probably guess that last year, cars were sold differently than in the showrooms of car dealerships. But Google took the trouble to measure what changed. While for the whole of 2018, only 1% of car sales took place online, in the first half of 2020 already 1/10 cars were sold that way. The big surprise, however, was the fact that 73% of buyers fully accepted this channel, and were able to easily negotiate all the conditions, including financing, fully online. As many as 24% of buyers received a dealer offer for a test drive from home. 98% of them considered it important for their final purchase decision.

As car sales shifted to online during the lockdown, customer expectations also changed. As many as 65% of buyers expected more options when shopping online. This is due to a much more competitive and less geographically limited environment. Suddenly, the approach to customers began to play a more important role. In addition, for new customers, the complexity of the pre-sales phase has increased. On average, while previous car owners are considering between fewer than 2 different models, new customers are considering more than 3 different models. The dealership is not only fighting on its behalf but must also be able to sell a specific type of model which is currently in stock.

The way car dealers communicate with customers has changed

Last year it became clear that customer communication played a very important role in sales. And especially the electronic communication channels – advertisements, social networks, newsletters, etc. And the Google data shows why. Every searcher needs their own messaging. Personalized advertising showed an 11% higher intent to purchase and a 7% higher clickthrough rate. In addition, meaningful messaging was 31% more important to brand love and 28% more important to brand trust than people realized.

The key to success were narrowly targeted offers, for example to new parents, a customer group that from 2021 has begun to grow rapidly worldwide. In 2021, it is not a question of selling a specific model of a specific brand, but of being able to responds to the needs of a specific SUV customer who wants the most rear space, the best family SUV, or the safest mid-sized SUV.

CRM in car sales brings measurable benefits

The only chance to succeed in a significantly transformed market is to have an accurate understanding of your customers’ needs as well as more flexible, targeted, and faster communication than your competition. This is impossible without the use of professional CRM software for car dealerships. If you do not have the tools in your dealership that provide a comprehensive view of each existing and potential customer while being able to incorporate data from social networks, you will have a problem in 2021. Google research has clearly shown that an investment into a tool like Automotive CRM from Konica Minolta, will pay off.

Sources

Think with Google, Rider to Driver Auto Trends 2020, https://www.thinkwithgoogle.com/consumer-insights/trending-data-shorts/rider-to-driver-auto-trends

Cars are starting to be dominated by software; will it be a new business opportunity?

Not so long ago, a new function could be added to a car just by having it installed by a service technician, such as parking sensors. However, with the advent of the Tesla Model S, the situation began to change. Cars have begun to acquire new features gradually, and they can be upgraded similarly to mobile phones or your TV. Traditional car manufacturers are now moving in the same direction. But what does this mean for car dealerships and services?

Tesla changed the rules of the game

The arrival of the Tesla Model S in 2012 literally revolutionized the automotive industry. However, it did not take place only on the vehicle side. The Model S came with a completely unknown phenomenon in the automotive industyr. Elon Musk, an “IT geek” brought to the world of cars something that was previously reserved for only smartphones and computers – his cars were suddenly able to acquire new, and often very attractive features, only thanks to software updates. As with smartphones, it is downloaded to cars via OTA (Over-the-air) updates, directly through a wireless internet connection. And so the on-board camera, the green traffic light warning, improvements to driver assistant systems, which Tesla calls Autopilot, and much more gradually appeared in the Model S. As more and more interesting features have increased over the years, so has the pressure on the competition.

Software access has moved from the computer to the automobile

However, the others could not react for many years. Why? The logic of their onboard systems was different. Whereas Tesla used a single computer for all key functions, from Autopilot, through pedal response control, to infotainment, other manufacturers opted for an architecture consisting of separate control units and independent infotainment, which often varied depending on the specific equipment level. But with the advent of intelligent assistance systems, this began to change. These systems need sufficiently strong and robust hardware and by definition are interconnected to the car’s onboard systems. In addition, technology that meets automotive industry standards has become widely available. The key role was taken over by the company Nvidia, whose platform Drive, has gradually made its way to Daimler, Toyota, Volkswagen, Hyundai, and Volvo in recent months, where it will cover systems and at least partial autonomous control.

From graphics cards to the onboard systems of the S-class

The first tangible results were not long in coming. Mercedes-Benz revealed in September 2020 that the upcoming seventh generation of its flagship would be able to expand its functions remotely. However, unlike Tesla, this will not be offered for free. While the abilities of the autonomous steering systém (SAE class 3) will be improved automatically based on new data for Nvidia’s onboard AI, customers will have to pay for new functions.

Mercedes, who is not alone in this, wants to open up the possiblity of direct upselling in the future, i.e. additional sales uplift for a given customer. However, it can be expected that dealers will also play an important role in these upsell activities, especially for fleet sales. After all, the transition to a new version of Microsoft Office is usually handled by a Microsoft partner, not Microsoft itself.

Who will care for the car software?

Velmi důležitou otázkou je také, jak bude vypadat vlastně ono rozšiřování funkcí na dálku, případně správa a údržba čím dál komplexnějšího software. V současné době jej provádějí servisy, a to včetně aktualizací software pro infotainmenty, řídicí jednotky motorů apod. Lze předpokládat, že ani s inovovanou architekturou aut, se část aktualizací bez servisů neobejde. Navíc, stejně jako v případě počítačů, telefonů anebo Tesly, ne každá aktualizace proběhne bez problémů.

Starost o software aut a přidávání nových funkcí tak bude do značné míry přenesena na dealerství a servisy. To je ale nová, velmi zásadní a patrně i lukrativní příležitost. Na rozdíl od prodeje fyzického příslušenství jako jsou koberečky a střešní nosiče vám totiž neváže ani finanční prostředky, ani místo ve skladu. Jen to bude vyžadovat nové prodejní dovednosti, nový přístup k zákazníkovi, a hlavně novou kategorii informací o každém servisovaném vozu a potřebách vašich zákazníků. Jste na novou kategorii prodejů připraveni? Počítáte s tím ve svém obchodním procesu? Využíváte nějaký specializovaný CRM software jako například Automotive CRM , který vás v příchodu nové obchodní příležitosti podpoří?

A very important question is also what the expansion of functions or the administration and maintenance of increasingly complex software will look like. Currently, this is performed by vehicle services, which also update software for infotainment, engine control units, etc. It can be assumed then, that even with innovative architecture, some partial updates will need to be performed at the service center. In addition, as with computers, phones, or even Teslas, not all updates go smoothly.

Concerns about automotive software and the addition of new functions will thus be largely transferred to dealerships and service centers. This is a new, crucial, and likely lucrative opportunity. Unlike the sales of physical accessories, such as carpets and roof racks, it does not require financial investment or even space in the warehouse. It will only require modified sales skills, a new approach to the customer, and most important, a new category of information about every serviced vehicle and the needs of your customers. Are you ready for this new sales category? Are you planning with it as part of your sales process? Do you use some kind of specialized CRM software such as Automotive CRM, which will support you in the arrival of a new business opportunity?